Natebishop3

Don't tread on me!

- Joined

- Sep 17, 2008

- Messages

- 94,328

- Likes

- 57,641

- Points

- 113

Fuck it's temping to buy another share. It's at $230 right now.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Fuck it's temping to buy another share. It's at $230 right now.

I'm still diamond hands on my meme bets. Ive spent about as much as I feel comfortable with at this point so I won't buy more but I'm riding out my current positions for awhile longer. I havnt sold any yet, especially AMC. I think AMC is all of a sudden a good recovery play investment, this recent surged saved them they can coast for awhile now, then all this free GME/AMC hype/advertising is a real short term wild card. I have a few of all the meme stocks but AMC is my big play, since I missed the best part of GME.

I'm still diamond hands on my meme bets. Ive spent about as much as I feel comfortable with at this point so I won't buy more but I'm riding out my current positions for awhile longer. I havnt sold any yet, especially AMC. I think AMC is all of a sudden a good recovery play investment, this recent surged saved them they can coast for awhile now, then all this free GME/AMC hype/advertising is a real short term wild card. I have a few of all the meme stocks but AMC is my big play, since I missed the best part of GME.

Have AMC - or any of these meme companies - raised more capital on the back of this boom? If not, the increased stock price doesn't help them much.

If I were them I'd be filing a secondary offering as fast as I possibly could. But I haven't read about any of them doing that.

barfo

Yes for AMC especially, they raised 300m on the stock craze. Reddit actually saved the movie theaters with this. That's why they are actually a good recovery investment play now.

Yes for AMC especially, they raised 300m on the stock craze. Reddit actually saved the movie theaters with this. That's why they are actually a good recovery investment play now.

I bought like 6 or 7 shares of AMC and BB. Not planning on dumping those quick. Just gonna hold onto them.

I'm currently at 3 shares of GME. That's gonna be it for me.

@EL PRESIDENTE it's almost down to your $200 line

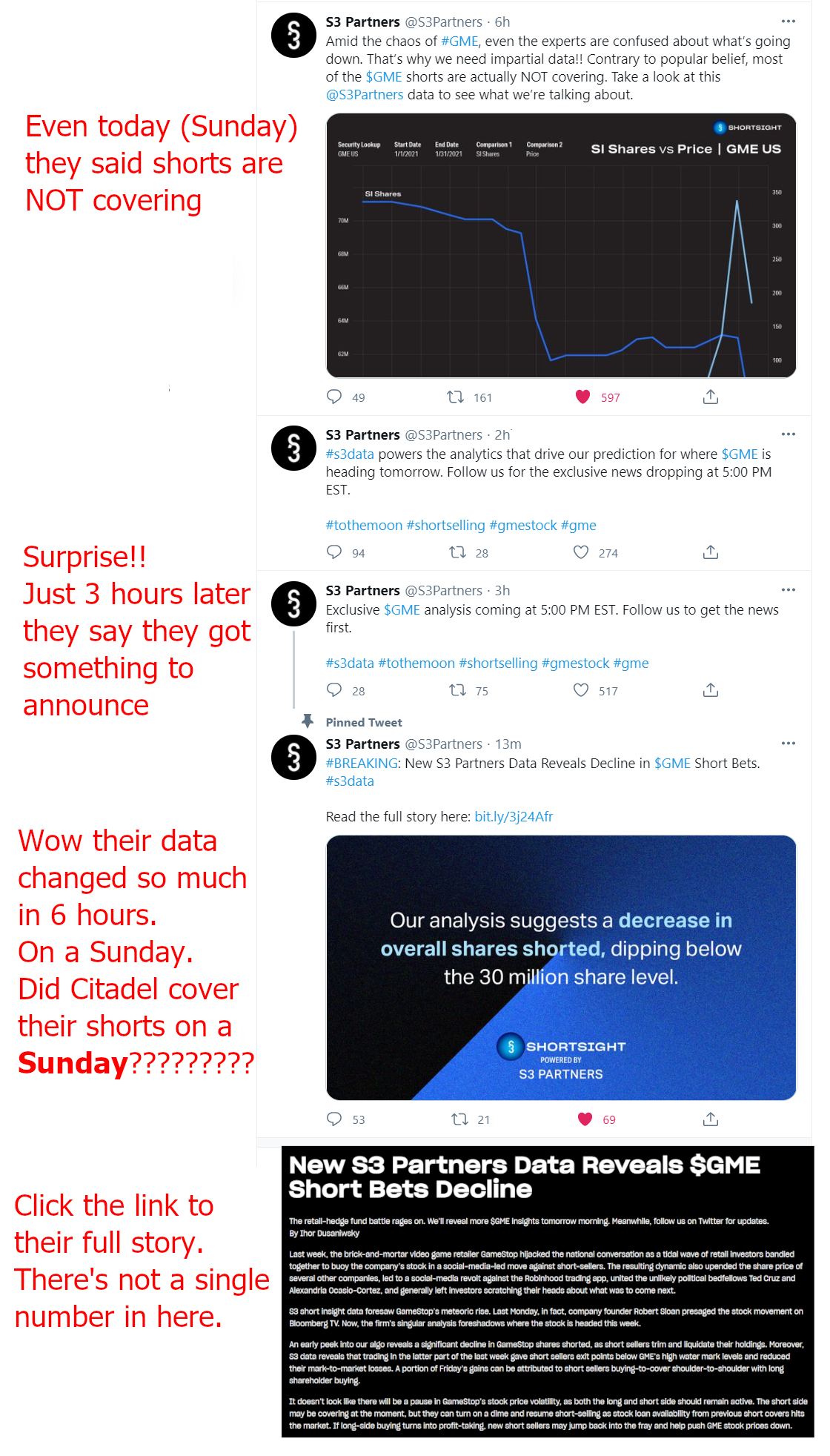

The number of GameStop shares shorted fell by 35.2 million over last week, leaving 27.1 million short positions remaining, or a drop of 56%, according to S3 data.

@SlyPokerDog how many shares are you sitting on?

What's the deal with silver? Apparently people are saying it's getting pumped and blaming wsb, but wsb is denying. Kind of wierd side story so far.

Apparently the Hedge funds that fucked around and got themselves in this mess own interests in silver. The theory is that these companies are planting stories trying to divert the WSB people away from GME in order to spread their money thin to make it easier on them to cover their shorts somehow. I don't know shit, so don't listen to me, I just want free money.

Fuck man I buy one more!I'm locked and loaded to buy in the morning depending on early activity.

AMC or GME?

Whats the better choice, all this being equal?

I think it’s shorted but not as much as GME.Is AMC shorted like GME is?