dviss1

Emcee Referee

- Joined

- Aug 10, 2011

- Messages

- 29,761

- Likes

- 27,781

- Points

- 113

Except it did work.

The rest of your post is great!

No, it didn't work. Most new income goes to the top 1%. How's that working out for the rest of the 90%? It's not.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Except it did work.

The rest of your post is great!

So how does Bernie adopt the model of Scandinavia then? How will Bernie tax +50% of the GDP?

Link on the top 1% earning 90% of all revenue in the USA. I'm calling bullshitMore bullshit that you're pulling out of your ass. He's talking about taxing the top 1% at 90%. I'm all for that.

He said he wants to do that, but he also said he wants to follow the economic model of the Scandinavian countries. They are all +50% GDP. So copying that model would mean that we will tax accordingly right???More bullshit that you're pulling out of your ass. He's talking about taxing the top 1% at 90%. I'm all for that.

Link on the top 1% earning 90% of all revenue in the USA. I'm calling bullshit

Oh wait, you want to tax them 90%? Lmao like that is gonna happen. And even if it did, that's only 40% of all revenue (being very gracious). And they are already being taxes 42%. So what else???

A lie?! It's the tax code. Are you saying get rid of the tax loop holes??? Well shit yeah we do that! But anyone making over 500k must pay 42% fed tax.That's a goddamn lie. How many one percenters do you know? I know three personally and they want their taxes raised. They certainly have found a way to avoid paying taxes. Their effective tax rate is not anywhere near 42%. Remember when Mitt Romney was only paying 13% plus? The fact that you want to spout 42% is just complete bullshit.

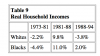

I've been bitching ever since Reagan took the top marginal tax rate down from 79% to 29%. Fuck trickle down economics. They have never worked and never will work.

A lie?! It's the tax code. Are you saying get rid of the tax loop holes??? Well shit yeah we do that! But anyone making over 500k must pay 42% fed tax.

AND, anyone making less than $18,550 paid no taxes at all.

Tax cuts for everyone (not just the rich) meant more money in consumers' pockets, which they spent. This stimulated business growth and additional hiring.

Result: Reagan's policies were an important part of bringing about the second longest peacetime economic expansion in U.S. history.

See this is why I can call bullshit. Most people making over 500k don't do it in earned income. They usually do it with capital gains. That's why Mitt Romney is only paying 13% plus. So when you throw this bullshit as 42% number out it's misleading and you know it. Am I saying get rid of tax loopholes? Hell fucking yes I am! Let's get rid of the ability to put your business in the Cayman Islands in Dodge taxes. Let's get rid of the subsidies that we give to oil companies in agro companies. Monsanto doesn't need any more of our money. On top of it, all of you day traders need a STET Tax too. Private eyes you're bailouts instead of socializing them. Those bankers sure loved socialism when it was paying their bailout...

Okay, so you believe everything he just said will be accomplished? Do you really think free healthcare, schooling and social welfare will be less than 50% GDP? Show me...

I am all for an equal "flat tax".This will not work in our country. We have 319+ million legal citizens and lord knows how many illegal immigrants, Scandinavian politics may work in that part of the world because there are only what ~26.5 million people in the region? People also are flocking to the Scandinavian region every day at our rate.

If we ever want TRUE equality (because people are so concerned about things being "fair") implement a flat tax on everything from income to capital gains.

Why should we hammer the rich? Just because they can afford it? No, that's stupid because the "rich" are our job creators for the most part. We raise taxes largely? Say goodbye to small business, or at least to the employees of said business. Soon enough we are all suckling on the governments tit because there are no jobs and the "benefits" of our government would slowly deteriorate because NO ONE IS MAKING ANY INCOME TO TAX FROM.

Okay, so you believe everything he just said will be accomplished? Do you really think free healthcare, schooling and social welfare will be less than 50% GDP? Show me...

Bush expanded Reagan's trickle down economics and look what happened. He put it on steroids and we know the outcome. Do you really want to charge someone that's making less than $19,000 a year taxes? Really? This whole idea of balancing the budget on the backs of the poor sickens me.

No, I am asking you how does "Bernie Sanders" accomplish an economic model of Scandinavia of 50% GDP? You know damn well that is what he wants and what he will push for. So how is he going to do it? Does the current "gameplan" you posted a link from his campaign site explain how we can accomplish this?So now it's do you believe everything he said will be accomplished... You're hilarious mags. The only thing Trump knows when it comes to the economy is how to file for bankruptcy.

I am all for an equal "flat tax".

Look at how much budget we give for the IRS. We could save a lot of that because we won't have to audit tax write offs.

http://www.irs.gov/PUP/newsroom/FY 2014 Budget in Brief.pdf

What do you have against people working? Anyone that wanted to work had a job when Bush was President.

I owned a business in Portland back then. I could not fill all of the jobs I had; many of the people I had to hire were under qualified.

Here is a chart comparing Obama's and Bush's employment record during their first term.

View attachment 5838

How is it regressive? You can cut the IRS budget by 74%, which is hundreds of billions. I think if all pay into the kitty, we can have these socialized welfare projects you want so badly.Of course you are for a flat tax. Most Republicans are because they know a flat tax is regressive on the poor. Middle class people spend 100% of their money in the economy. As opposed to the rich who spend about 35% of their money. Who's paying more taxes then? A flat tax is bullshit and we know it. Next thing you know you'll be talking about your 9-9-9 plan...

No, I am asking you how does "Bernie Sanders" accomplish an economic model of Scandinavia of 50% GDP? You know damn well that is what he wants and what he will push for. So how is he going to do it? Does the current "gameplan" you posted a link from his campaign site explain how we can accomplish this?

How is it regressive? You can cut the IRS budget by 74%, which is hundreds of billions. I think if all pay into the kitty, we can have these socialized welfare projects you want so badly.

Oh okay, so you punish those that want to save their money over the one that blows their load? No fucking wonder this country is a messI just explain to you how it was regressive. A flat tax is a sales tax. You tax the spending of individuals when you do that. The truth of the matter is that middle class people spend way more of their money than rich people do. It's simple math.

Oh okay, so you punish those that want to save their money over the one that blows their load? No fucking wonder this country is a mess

See I was poor. I had a family of 4 with a combined family income of $36k. I tithed 10%, owned a home, had 1 car and ate well. We had money left over to save.True this post truly shows your ignorance with regard to our consumer driven economy. The poor and middle claspse have to spend 100% of their money.

See I was poor. I had a family of 4 with a combined family income of $36k. I tithed 10%, owned a home, had 1 car and ate well. We had money left over to save.

Oh okay, so you punish those that want to save their money over the one that blows their load? No fucking wonder this country is a mess

No, it didn't work. Most new income goes to the top 1%. How's that working out for the rest of the 90%? It's not.

Bush expanded Reagan's trickle down economics and look what happened. He put it on steroids and we know the outcome. Do you really want to charge someone that's making less than $19,000 a year taxes? Really? This whole idea of balancing the budget on the backs of the poor sickens me.