- Joined

- Jul 15, 2007

- Messages

- 15,057

- Likes

- 8,662

- Points

- 113

Facepalm.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Facepalm.

Facepalm.Exactly what I wrote

Facepalm.

You were arguing with your chart for them to take the standard when the itemized was larger and would decrease their taxes more.

Which shows your calculation to be silly.

I was getting a little nervous but the wife and I are usually in between the top two red arrows somewhere so it can't be too bad. For us anyway.View attachment 16359

The red arrows are the "middle class" who pay more.

If you make $225K, you're not exactly poor.

Lol. Agi and taxable income arent the same thing. Which again shows your chart is stupid.I was not. I posted that someone making $250K has their tax go up. And asked if that level of income is middle class.

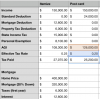

The $150K example, including state income tax of 10%:

View attachment 16367

No you're not. You're assumptions don't even make sense. You're adjusting the effective tax rate willy nilly.I'm using the same kind of assumptions your 2nd link does.

Obviously people have all kinds of other deductions under current law. Schedule C, Schedule A, etc.

I'm overstating the state income tax at 10%, FWIW.

Since they havent made the tax brackets known, that means you are admitting your charts are useless.I didn't list any schedule C items, or any other schedule A (like charitable contributions). They obviously affect the tax scenario. The column on the right gets the C income/loss but doesn't get the A ones (other than charity and mortgage interest).

They haven't made the tax bracket cutoffs known. In order for the $150K married couple to pay less in tax, the effective tax rate has to be less.

That's what we need to watch for when congress debates the bill and works out the details.

Since they havent made the tax brackets known, that means you are admitting your charts are useless.

Stop adjusting the effective tax rate willy nilly. Your spreadsheet was off.

It didnt have to list schedule c items. It would have already been included in coming to your AGI bro.

And more schedule a deductions is better for the middle class person today than it would be for whatever is on the right side of your spreadsheet.

Schedule c income is not taxed at a different rate. Neither are s corps or partnerships. They are taxed at the individuals rates. Again. They both would be included in the AGI number so are irrelevant to whatever you're arguing.How are they useless? They show that the effective tax rate needs to be something like 15% for the $150K married couple to pay lower taxes.

Schedule C matters because the pass through rules will change, too. But they're likely to stay the same, so fine. If they're taxed at 25%, it's a hike.

I already stipulated that the schedule a deductions favor the left column. Bigly.

View attachment 16372

Schedule c income is not taxed at a different rate. Neither are s corps or partnerships. They are taxed at the individuals rates. Again. They both would be included in the AGI number so are irrelevant to whatever you're arguing.

You straight up listed the effective tax rate at 15% in your spreadsheet when they would not have been 15% based on the same tax brackets.

Bigly means nothing to me btw.

LOL! So you made up an effective tax rate on your right column to try to get your point accross?

A LLC means nothing. Its not a tax entity. A LLC has to file as a schedule c, s corp, partnership or c corp.

The business tax rates for c corps would change if he lowered corporate tax rates for sure. I have only seen speculation on what he meant by "all businesses"

I'm not a far lefty. So that won't rile me up.

I used the tax rates from your graphs to show your spreadsheets were false which are the brackets going around the internet currently.

Huh? A LLC can be any of the business entities. Today, a LLC is not treated the same as a s corp unless it is a s corp. A LLC basically means nothing in the tax world.

Many small businesses are taxed at the 10% or 15% rate right now on the individuals return.

It will be interesting to see what ends up happening.

I think it's fools gold though.

How do we know that? 12%, 25% and 35% is what everyone is reporting.

I agree we don't know for sure, but based on your charts and what is being discussed the middle class in most situations (almost all when they own a house, because with no SALT or property tax deductions, they wouldn't be able to itemize) would be fucked.

If he makes the 12% rate go up substially higher than a taxable income of 75k, we can hash this back out.

Don't see that happening though.

If the poor and rich both end up paying less.....who gets screwed?

Trump said it himself, he wants three brackets of 12%, 25% and 35%. That is what is in the Republican framework of tax reform.

I've also said that. And i've agreed with that point. When that gets released i will be more than willing to discuss how it will affect the middle class.

And i used your cute little graph to proof based on those numbers, middle class people who itemize end up paying more.Hence my spreadsheet trying to figure out the EFFECTIVE tax rate required to not raise taxes on the middle class. It suggests some range of values for the income ranges for the brackets that work.

And i used your cute little graph to proof based on those numbers, middle class people who itemize end up paying more.

You were the one pushing it. I showed it was false. What more do you want?Based upon income ranges that nobody knows.

Hardly a "proof." More like a contrived case, as I admit my own is as well.